The Group Insurance Board set guidelines on health premium rates for 2025. Rates are generally higher next year, but several premiums for 2025 continue to be among the lowest-cost plan options for members. Actual monthly premium costs will be included in the open enrollment materials, which will be posted prior to the annual open enrollment period (Sept. 30-Oct. 25, 2024).

Reasons for Premium Increase

The increases next year are primarily driven by the impact of three factors:

Rising Healthcare Costs

Healthcare costs, including medical, pharmacy, and dental, have increased across the insurance industry. These are projected to continue to surge along with inflation, affecting all elements of healthcare including provider wages, medical supplies, etc.

Stabilizing the Reserve Fund

The Board has a reserve fund for the Group Health Insurance Program. The reserves are used to pay prescription and dental claims and operations, as well as protect the program against possible adverse experience and negative market trends. The reserve funds are affected by investment returns.

For seven years until 2023, the Board used reserve funds to reduce premium rates. In 2024, reserve funds dropped too low to continue reducing premiums. Beginning in 2025, the Board will rebuild the reserve fund by adding 0.8% to premiums.

Administrative Costs

Administrative fees pay for operational costs to run the program, including compliance audits, actuarial services, ETF staff salaries, maintaining the data warehouse, and systems.

Premium Increase by Plan Category

Below summarizes the average premium rate increases by plan category.

Active Employees

- State employees: 7.3% -- The Department of Administration, Division of Personnel Management sets the premium contribution for state employees and the employer contribution to the Health Savings Account.

- Local employees: 11% -- The premium contribution for local employees is determined by each individual employer. This increase is higher than the increase for state employees because local employers may choose to stay in or leave the program each year. This change in membership creates potentially more risk for health plans, which affects the stability of premium rates over time.

Retirees

Health insurance (without Uniform Dental) premium changes are plan-specific.

| State Retirees | Local Retirees | |

|---|---|---|

| Non-Medicare | 3% to 15% | 3% to 29% |

| Health Plan Medicare | 5% to 20% | 6% to 26% |

IYC Medicare Advantage Continues to be the lowest-cost Medicare plan option. | 20% A member with individual coverage will pay an additional $54.66 each month. | 20.50% A member with individual coverage will pay an additional $55.96 each month. |

| Medicare Plus | 9% | 9% |

IYC Medicare Advantage premiums are affected by changes in federal subsidies based on Medicare's annual star rating. Medicare evaluates each plan’s customer satisfaction and quality of care, with highest-rated plans getting the largest subsidies.

The IYC Medicare Advantage plan has been in the highest star category since it has been offered by UnitedHealthcare. Unfortunately, Medicare reduced subsidy payments across the board for 2025. Despite this, IYC Medicare Advantage remains the lowest-cost Medicare plan option for members.

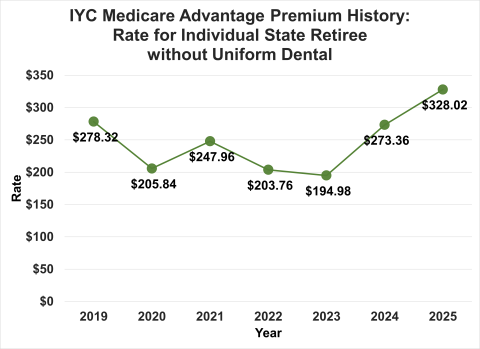

The chart below shows how the IYC Medicare Advantage premium has changed from 2019 to 2025.