Download PDF

Summary

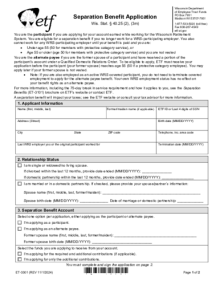

By applying for a separation benefit, you understand the following:

- I understand that by taking a separation benefit I am closing my WRS account. All service and contribution balances will be returned to zero and any employer contributions will be forfeited. If I return to WRS-covered employment after the required break in service, my account will be treated as if I were a new employee for all programs and there will be no prior service or contributions available to be added to future retirement benefits.

- I understand a separation benefit will impact my taxes. See the ETF website or consult your tax advisor for more information. If you do not roll over your lump-sum payment, ETF must withhold 20% of the taxable portion of your payment for federal income tax. ETF does not withhold state taxes from lump-sum payments.

- I understand that if I return to any WRS-covered employment within 75 days of my current termination date, my separation benefit application will be canceled, and I will be required to repay any benefit that has already been paid.

- I understand that I may cancel my application by sending a written request to ETF and that this request must be received before the date on which my benefit payment is issued. If I die before my benefit payment is issued, my application will be canceled automatically.

- I hereby apply for the benefit option I have selected, and request that my eligibility for, and the amount of my benefit be determined in accordance with the Wisconsin laws that will provide the highest benefit to which I am entitled.

- I understand that Wis. Stat. § 943.395 provides criminal penalties for knowingly making false or fraudulent claims on this form and hereby certify that, to the best of my knowledge and belief, the above information is true and correct.