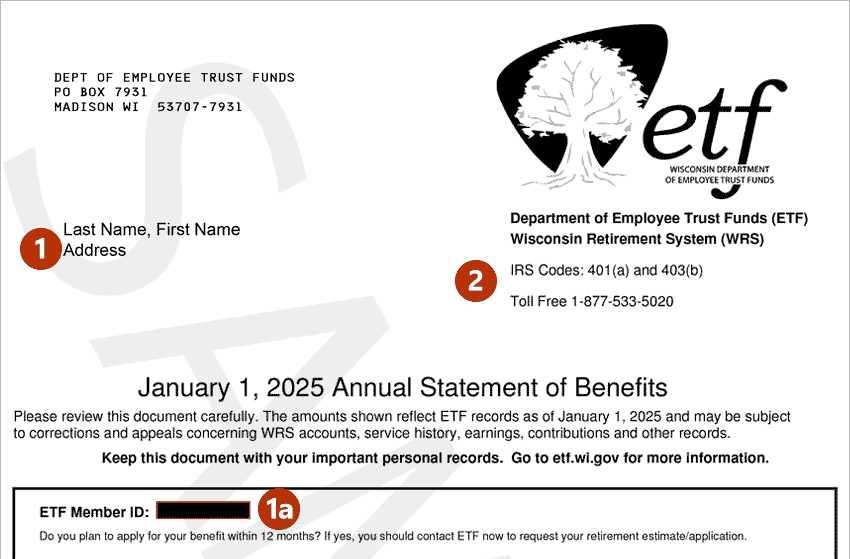

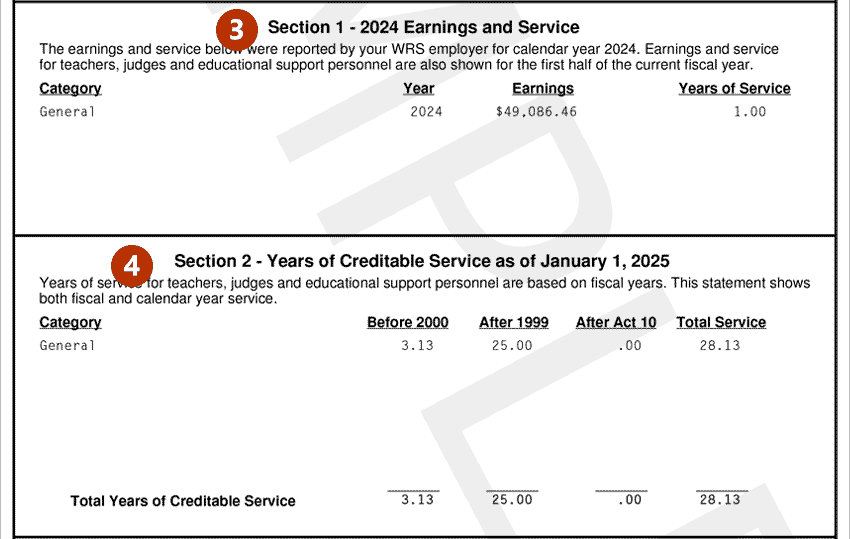

A sample form of the Statement of Benefits is divided into parts with details to help you understand the information. Click on a section to navigate to or scroll down to each section. After you finish a section, click on "Back to top" to navigate to a new section. Follow along on your own Statement of Benefits. If you do not have your own to look at, download the sample above.

See the Calculating your Retirement Benefits (ET-4107) brochure for more information, including the various formula multipliers.

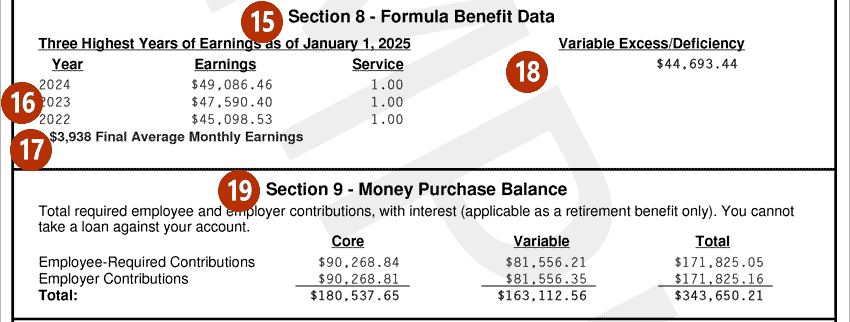

Your three highest years of WRS earnings. The years do not need to be three years in a row, nor your three most recent years.

If you have simultaneous service (you are an active employee working for two WRS employers for both calendar and fiscal year earnings), please note that your three highest years of earnings in Section 8 are reported on your annual statement only by fiscal year earnings.

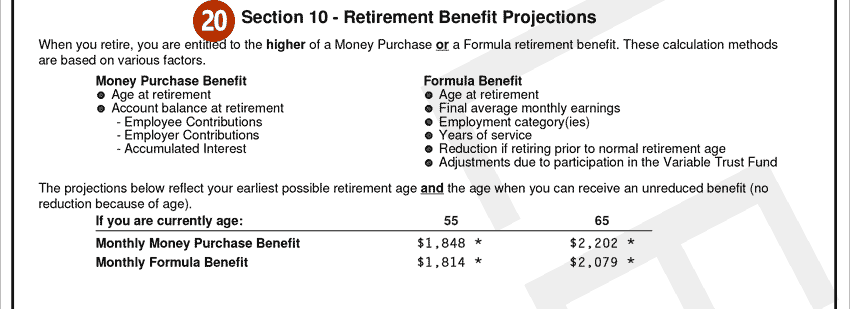

Section 10 – Retirement Benefit Projections: This section shows estimates for your retirement benefit under both the money purchase and formula methods. These are not official estimates; they are for your general information only. For more information about projecting your retirement benefit, see the WRS Retirement Benefit Calculations page.

You may request a retirement estimate six to twelve months before you plan to retire (or before you plan to apply for benefits if you are not an active WRS employee). You must be vested to receive a retirement benefit. For more information about these requirements see vesting and how the WRS retirement benefit works. If you are unable to work due to a permanent disability, call ETF immediately to request disability benefits information.

Your eligibility for a one-time, lump-sum payment versus a monthly payment depends on the size of your For Annuitant’s Life Only benefit. Annual minimum and maximum amounts are determined by state statute as modified by federal law. See the Annuity Payment Options page for current rates.

If you are older than the normal retirement age for your employment category, the amounts are calculated based on your age as of January 1.

Members with Protective and other WRS-creditable service:

This retirement projection shows your estimates for both your “minimum retirement age” and “normal retirement age.” Your minimum retirement age is the earliest age you can begin a retirement benefit, at a reduced amount because the benefit is expected to be paid longer. Your normal retirement age is the age at which you can receive a full benefit without an age reduction factor. This calculation takes into account all employment categories for which you have service. Depending on your age and years of creditable service, these dates can be the same and produce only one benefit projection.

Please note, your statement does not include any account receivable amount due if you have an outstanding balance pending. Any monies owed on your account will be deducted from your WRS benefit, if not paid in full, before you apply for benefits.

Additional Information about Required Minimum Distributions

Once you stop working for a WRS employer, federal law requires you to begin receiving your benefit payment(s) by a certain date, depending on your age. This is called a required minimum distribution (RMD). Visit the Required Minimum Distribution page for detailed information about current RMD requirements, and the potential impact a RMD may have on your WRS benefits and tax liability. You may also want to consult with your tax advisor.

It is important for you to contact ETF before a forced distribution is required. Once a forced distribution begins, your ability to choose a different payment option, if available, will be very limited. Your WRS account will be closed and you will not be able to return your payment(s).