Summary

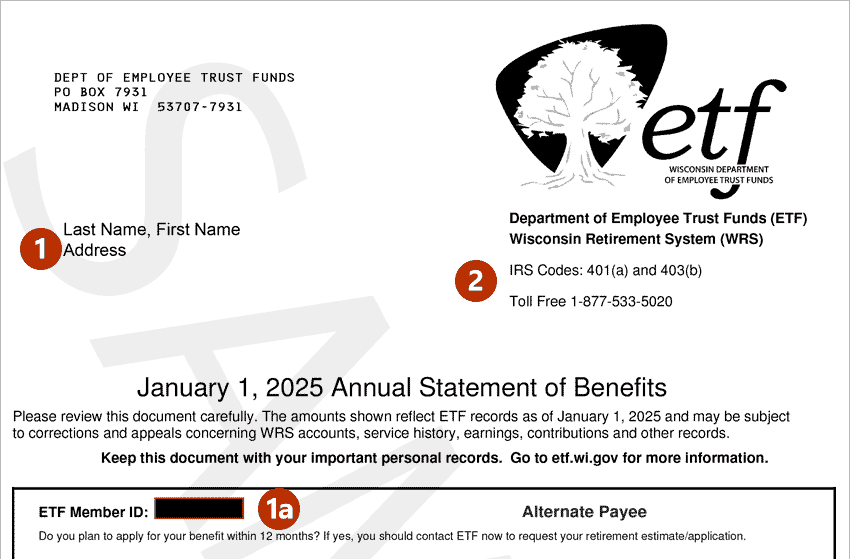

A sample form of the statement of benefits for an Alternate Payee.

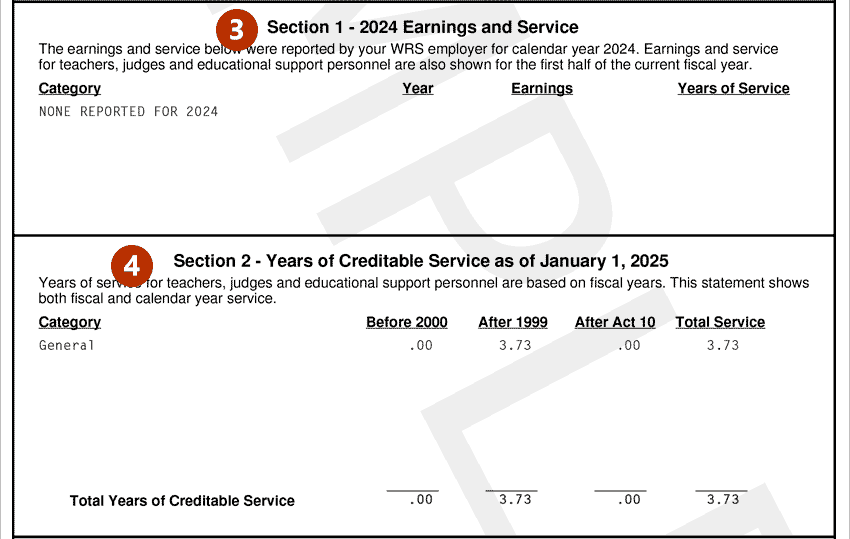

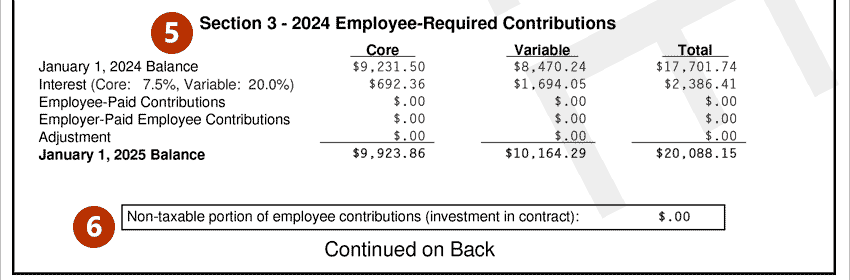

A sample form of the Statement of Benefits is divided into parts with details to help you understand the information. Click on a section to navigate to or scroll down to each section. After you finish a section, click on "Back to top" to navigate to a new section. Follow along on your own Statement of Benefits. If you do not have your own to look at, download the sample above.

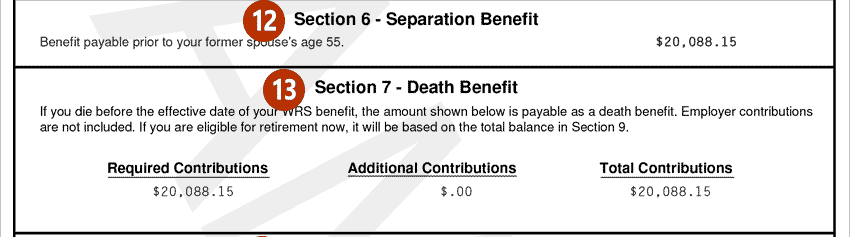

Section 6 – Separation Benefit: This section shows the amount available if you are eligible to receive a separation benefit. A separation benefit is a one-time (lump-sum) payment consisting of employee contributions, additional contributions (if applicable), and interest. It does not include employer contributions. If you choose this option, you will lose the employer contributions (if vested) and your account will be closed.

You may take a separation benefit under one of two circumstances:

An alternate payee can apply for a benefit even if the participant is still employed under the WRS. Once the participant reaches minimum retirement age (if you are a former spouse), and is vested, you are eligible for a retirement benefit based on both the employee and employer contributions.

Some participants must meet one of two vesting laws based on when they first began WRS employment. As an alternate payee, your vesting status generally depends on whether your former spouse/domestic partner is vested.

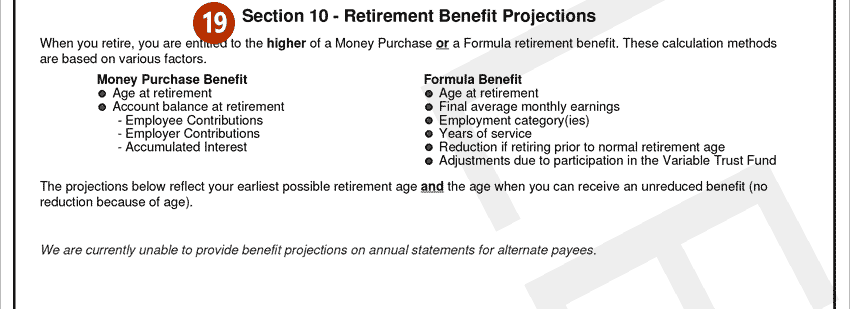

Contact ETF to request a retirement benefit estimate 6 to 12 months before you plan to apply for a retirement benefit. Please note, your statement does not include any account receivable amount due if you have an outstanding balance pending. Any monies owed on your account will be deducted from your WRS annuity, if not paid in full, before you apply for benefits.

Additional Information for Vested Alternate Payees

If you are vested, you may want to consider applying for your retirement benefit as soon as you are eligible, regardless of your employment status or income. Delaying your retirement benefit may increase your monthly payment. Calculate how long it will take to recover the monthly payments and any annual increases that you will give up by waiting to begin your benefit.

Additionally, if you die before you begin receiving a retirement benefit, the death benefit will be less than your total account balance because you will forfeit the employer contributions.

Additional Information about Required Minimum Distributions

Once you stop working for a WRS employer, federal law requires you to begin receiving your benefit payment(s) by a certain date, depending on your age. This is called a required minimum distribution (RMD) . Visit the Required Minimum Distribution page for detailed information about current RMD requirements, and the potential impact a RMD may have on your WRS benefits and tax liability. You may also want to consult with your tax advisor.

It is important for you to contact ETF before a forced distribution is required. Once a forced distribution begins, your ability to choose a different payment option, if available, will be very limited. Your WRS account will be closed and you will not be able to return your payment(s).